Swing Trade Screening Criteria

Contents

Raindrops charts are volume-based candles/raindrops which you can read all about here. A balloon raindrop, is simply a raindrop that looks like a balloon. After you’ve ran a scan, you can see all the results on the right side of your screen and the corresponding chart on the left, which you can easily scroll through with your arrow key. However, if you don’t want to make your own criteria, you can simply choose some preset ones like you can see below.

Using Twitter is good to get a general sense of some potential trade ideas but it shouldn’t be relied on entirely unless your strategy is market sentiment related. Maybe you’re just a contrarian trader that trades based off sentiment. That’s perfect because creating a list of stock traders can help you gauge what the sentiment is for many retail traders on social media. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

How to Find the Best Trending Stocks for Swing Trading with FinViz. Traders are always on the lookout for the best rending stocks on a daily and weekly basis. Trending stocks are great for both swing traders and day traders. If you can identify a trending stock you can jump on for the ride! Careful though, you don’t want to pick something up at the end of its trend.

One way to identify the hot stocks that will move the best is to use a stock screener. We did an amazing introduction to our favorite three stock screeners. Swing trading is a popular strategy for those looking to make short-term gains in the stock market. One of the keys to success in swing trading is having access to accurate and timely information about potential trades.

Moving Average Screener

But where it stands out is its broad coverage of international stocks across 130+ global exchanges. That makes TradingView our pick as the best stock screener for global investing. The first two rules look for stocks that have been trending strongly over a period of four weeks, with the trend increasing over the past two weeks. The second two rules then scan for stocks for which the daily candlestick is straddling the 20-day moving average, indicating a pullback from the trend that may just be getting started. One of the other nice things about using the Breakouts module to look for swing trading opportunities is that you can search only your watchlist stocks rather than the whole market.

But allowing your emotions to rule your trading decisions can be disastrous. Most securities in the technology industry fell in unison in late 2018 given high valuations and fears of an economic recession. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. Read analyst reports and other sources to get a long-term view of the stock. Good companies, everyone needs their stuff, they make boat loads of cash and they swing all the time. Investors can link Stock Rover to their brokerage account for more robust reporting, portfolio analysis, and portfolio rebalancing recommendations.

Also, we filtered it to show stocks that are up on the day, and have at least 150,000 in trading volume. We use this scanner at least once a week when we’re in the process of writing our weekly watch lists. When a market drops to an area of support, bulls will usually step in and the market will bounce higher again. When it hits an area of resistance, on the other hand, bears send the market down. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. MAs are referred to as lagging indicators because they look back over past price action.

You can set crazy parameters that include timeframes spanning from the 1-minute time frame to the monthly time frame, which is why it’s useful for both day tradingand swing trading. Trading journals organize your thoughts and the reasons behind your decisions. If you delay entering a trade into your journal, the trades may eventually pile up and overwhelm you, and you may decide not to update the journal anymore.A trading journal is your coach.

Combining these two https://en.forexbrokerslist.site/s will highlight stocks that experienced a double-crossover within the last day or two, which is a very powerful bullish signal. These can be put together into a weekly watch list called “weekly trending stocks”. FinViz allows you to easily siphon through the charts you have screened by selecting “charts” in the tab selection under the screening criteria. Financial visualizations or FinViz for short has a very powerful and free stock screener. This is a measure of a stock’s price trend compared to another stock, the industry, or the market index. It compares the price performance of a stock against others.

Herd Behavior in the Stock Market

The same applies for bearish strategies.Instead of screening for 0-3% below highs, you can screen for 0-3%, 0-5%, or 0-10% above lows, depending on your preference. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

- This allows you to integrate certain types of trading strategies and to eliminate stocks from the list that may not fit specific criteria.

- Get 10% off TrendSpider plans byclicking here& using the coupon codeTS10when signing up.

- It had a perfect bounce after that move up during the first week of February that would have been a good swing trade… but here I am in March.

My preference in taking profits is to rely on a signal from a technical indicator rather than a pre-existing support or resistance level. So, I prefer to exit after a security breaks below an indicator, such as a moving average, or on a sell signal from a trending indicator. Finding potential trading opportunities as a swing trader can be challenging, especially when you’re trying to keep up with thousands of stocks in real-time. Our initial search revealed 30 stock screeners for our consideration. After a more rigorous comparison, we identified the best stock screeners in six distinct categories.

Moving Average Breaks

First a move from $9.00 to 11.50 for a $2.50 range, second a move from $10.75 to 12.50 for $1.75 range, and third a move from $11.75 to $13.25 for $1.50 in range. These three trades presented over $5.75 in trading range, more range than the last 6 months from low to hi. Breaks it down a little further and shows us the top performing sectors. When possible I like to trade within the top two or three strongest performing sectors.

You can choose from the standard or the premium plan, depending on the exact services you’re looking for. Has been around since 2003 and has in-depth tools that can be helpful to investors of all skill levels. Users can also apply their own customized criteria to find a more precise match.

On the next https://topforexnews.org/, the contraction is so small that the consolidation breakout basically kicks off the next up wave and breaks the whole pattern to the upside. In this case, the price had been so tightly squeezed the consolidation became the price swing. A very large and loose triangle is much more likely to be a topping pattern, and thus we don’t want to trade it. Measure the height of the contraction patterns so far in the uptrend. Triangles are everywhere, but I only trade them if they form a certain way, and only in very strong stocks near 52-week highs.

One of the most basic rules swing traders follow is to only trade liquid stocks. The daily minimum you select is arbitrary, but a reasonable example is 500,000 shares per day. You can exit high volume stocks quickly and with less risk of a loss from the bid-ask spread because stocks that are more liquid generally exhibit lower bid-ask spreads. Recognizing a bad trade or potential loss requires discipline and is a key tent of swing trading, which highlights the ability to quickly exit a trade.

Scanz makes it easy for swing traders to spot potentially profitable setups. Whether you use one of the scans above or bring your own swing trading strategy, the Breakouts module and Pro Scanner can help ensure you never miss a signal. Our revolutionary system is transforming the way investors take part in the stock market. Not only do we help you uncover winning swing trading stock picks on autopilot.

Swing Trading positions are usually held a few days to a couple of weeks, but can be held longer. If you want more control over your swing trade scans, you’ll want to turn to the Pro Scanner. Here, you can easily look for price breakouts that occur in conjunction with significant movements in technical indicators. In this case, we get 101 stocks that have met all of our criteria.

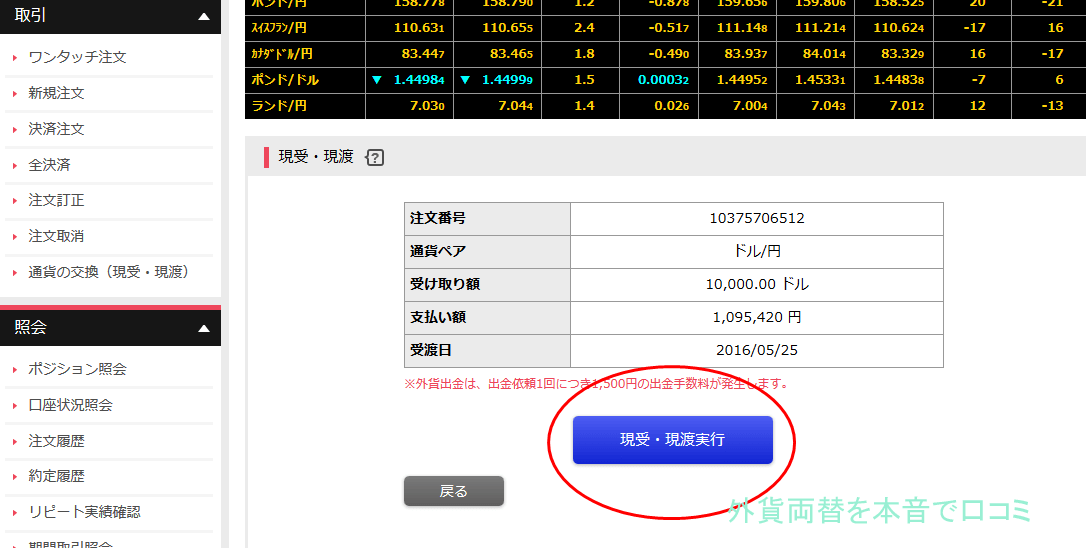

On this particular day, March 1st 2018, this screen produced 3 results.Two of the 3 look to have potential, FCB and WSO. I don’t like how FXB has very small-bodied candlesticks and looks to be somewhat choppy, with large gaps between the open and closes each day. It also doesn’t have a clean or relatively quick decline that could potential bounce. Take a look at the technical filters you can pick from to setup a screen from the image above. One thing, I have noticed…it is very hard to describe all of exactly what you are looking for and boil it down into a stock screen.

The filter starts with very broad criteria, then keeps narrowing the paramaters down to more and more specific requirements. I like the previous up move, which started with an initial breakout in late January, retraced to the breakout point, then rocketed higher. This is so important, because by taking the time upfront to create a screen that describes EXACTLY what you are looking for, you are helping yourself in so many ways. You can make Strategies specifically for the Screener, just add the criteria you want to screen for as Condition Building Blocks. The Screener runs your Strategy on the last bar of data of each Symbol in the selected Universe, and returns the Long and Short Signals.

How to Find Volatile Stocks Using Scanz

Benzinga Pro is widely recognized as one of the best https://forex-trend.net/ screeners in the industry in 2022. The stock screener also has dozens of filters, including the ability to sort by active price, swing percentages, volume, and more. If you’re looking for an effective stock screener and real-time updates for a variety of markets and exchanges, then you will definitely want to consider Benzinga Pro. These premium plans include access to portfolio management tools, historical stock market data, and the ability to take advantage of hundreds of custom screening tools and metrics. You learn about thousands of different types of stocks and filter through them based on volume, signals, price, and much more.

How to Find Breakout Stocks Using The Pro Scanner

Rather than the normal 7% to 8% stop loss, take losses quicker at a maximum of 3% to 4%. This will keep you at a 3-to-1 profit-to-loss ratio, a sound portfolio management rule for success. It’s a critical component of the whole system since an outsized loss can quickly wipe away a lot of progress made with smaller gains. Now it’s important to note at this point that you will very rarely find any results with all of these filters in FinViz Screen. And you are able to find more FinViz features on the dashboard. Based on what we screened, there are a few names that look interesting.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.